Depreciation is a key concept in accounting, and it plays an important role in determining the value of assets over time. For consumer electronics like televisions, depreciation helps assess how much value the TV loses over its useful life. Whether you’re an accountant, business owner, or simply a consumer wanting to understand how to calculate depreciation for your TV, it’s essential to know how to estimate this loss in value.

In this article, we’ll explore the factors that influence the depreciation of a TV, how to calculate depreciation, and a general guideline for estimating depreciation based on industry standards.

What is Depreciation?

Depreciation refers to the reduction in the value of an asset over time due to various factors such as wear and tear, technological advancements, and the passage of time. For businesses, depreciation helps to spread the cost of an asset over its useful life, which in turn reduces taxable income.

When it comes to consumer goods like TVs, depreciation is largely driven by technological obsolescence, physical deterioration, and market trends. A TV purchased today may have significantly less value a few years from now as newer models with better features hit the market, and the TV’s functionality might also diminish as technology evolves.

Factors That Influence TV Depreciation

Several factors impact how quickly a TV loses value:

Brand and Quality: High-end brands tend to depreciate slower than budget models. Premium features, such as OLED or QLED displays, may also affect the rate of depreciation.

Technological Advancements: TVs with older technology, such as LCD models, may depreciate faster than those with the latest technologies like OLED, 4K, or 8K displays.

Usage and Wear: Regular use, screen burns, and overall wear and tear can reduce the TV’s value faster. TVs that have been well-maintained tend to retain value better than those showing signs of heavy use.

Market Trends: Consumer demand for certain features, like smart functionality or 4K resolution, may cause some models to lose value more rapidly. For instance, a TV without smart capabilities might depreciate quicker in a market where streaming and connectivity are essential.

Physical Condition: A TV that is free from scratches, dents, or other cosmetic damage will generally hold value longer than one that is physically damaged.

Methods of Calculating Depreciation for TVs

There are several methods used to calculate depreciation, but the most common ones are straight-line depreciation and declining balance depreciation.

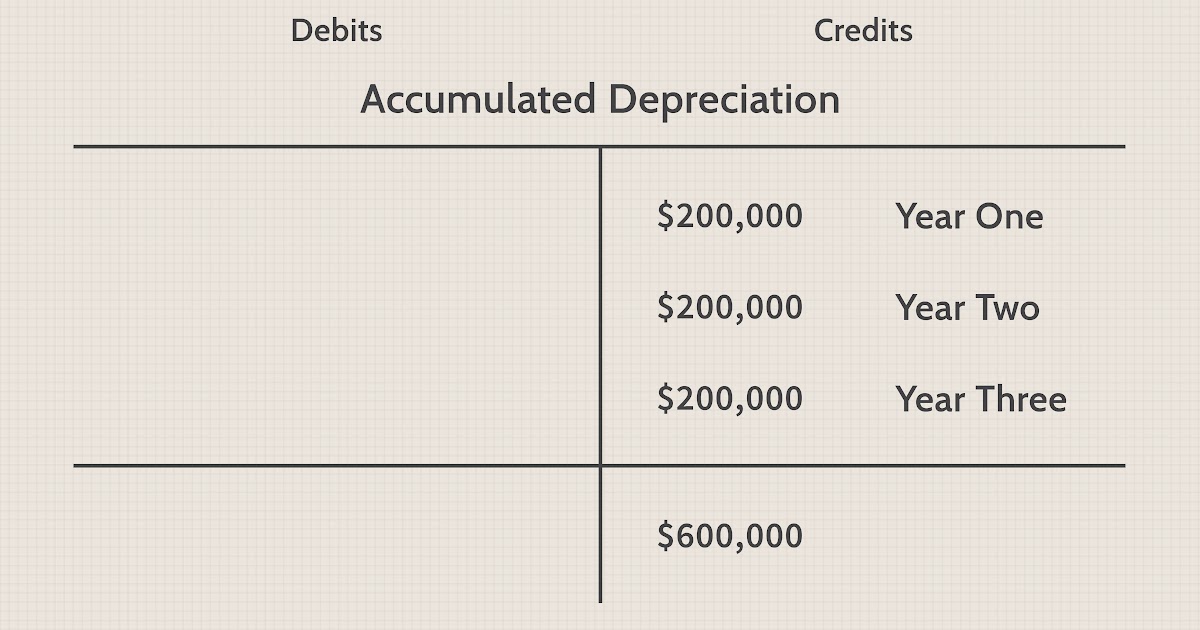

Straight-Line Depreciation

This is the simplest and most widely used method. It assumes that the asset loses an equal amount of value each year over its useful life.

- Formula:

Depreciation per year=Cost of the TV−Salvage ValueUseful Life\text{Depreciation per year} = \frac{\text{Cost of the TV} – \text{Salvage Value}}{\text{Useful Life}} - Example:

If a TV cost $1,000, has a salvage value of $100 after 5 years, and a useful life of 5 years, the annual depreciation would be: 1,000−1005=180 per year\frac{1,000 – 100}{5} = 180 \, \text{per year} This means the TV will lose $180 in value each year for 5 years.

Declining Balance Depreciation

This method accounts for higher depreciation in the earlier years of the TV’s life, assuming that the asset loses value more quickly at the start. This is particularly useful for technology products that become outdated fast.

- Formula:

Depreciation=Book Value at Start of Year×Depreciation Rate\text{Depreciation} = \text{Book Value at Start of Year} \times \text{Depreciation Rate} - Example:

If the TV has an initial value of $1,000 and the depreciation rate is 20%, then the first-year depreciation is: 1,000×20%=2001,000 \times 20\% = 200 In the second year, the depreciation will be based on the new book value ($1,000 – $200 = $800), and so on.

General Depreciation Guidelines for TVs

As a rough guide, TVs typically lose value quickly, especially due to the rapid advancements in technology. The following points can be used to estimate how much depreciation a TV might undergo over its useful life:

- First Year: Expect the TV to lose 20-30% of its value within the first year due to immediate obsolescence and market saturation.

- 2-3 Years: Depreciation may slow down to 15-20% per year, though technological advancements and new models still play a role in decreasing the value.

- 4-5 Years: The TV could lose an additional 10-15% of its value per year, especially as newer, more advanced models come to the forefront.

- Beyond 5 Years: After 5 years, depreciation tends to level off, though the TV will likely only have a small percentage of its original value left unless it has been exceptionally well-maintained.

Conclusion

Calculating depreciation for a TV can be done using different methods, but the most straightforward approach is using the straight-line method, where depreciation is evenly spread over the TV’s useful life. Typically, TVs lose significant value in the first few years due to technological advancements and wear, with a rough guideline suggesting that a TV might lose 20-30% of its value in the first year alone. However, the exact rate of depreciation can vary depending on factors such as the brand, model, and condition of the TV.For more information click globalleds.tech